20 Recommended Reasons For Choosing AI Stock Investing Analysis Websites

20 Recommended Reasons For Choosing AI Stock Investing Analysis Websites

Blog Article

Top 10 Tips For Evaluating The Data Quality And Sources Of Ai Platform For Predicting And Analyzing Trades

To provide accurate and reliable data it is essential to verify the data and sources that are utilized by AI trading and stock prediction platforms. Inaccurate data can lead to poor predictions, financial losses or a lack of trust to the platform. Here are 10 top tips on evaluating the quality of data and its sources.

1. Verify the data sources

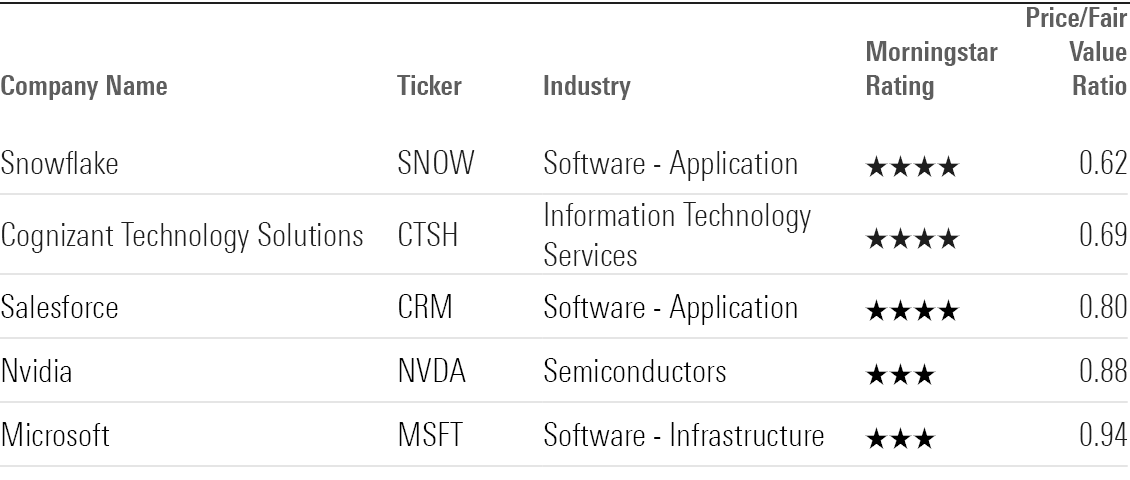

Verify the source of the data Check that the platform is reliable and well-known data suppliers (e.g., Bloomberg, Reuters, Morningstar, or exchanges such as NYSE, NASDAQ).

Transparency: The platform should be transparent about its data sources and should regularly update them.

Avoid dependency from a single source: Reliable platforms usually aggregate data from multiple sources in order to lessen bias and errors.

2. Assess Data Freshness

Data that is delayed or real-time Check if the platform offers delayed or real-time data. Real-time data is crucial for active trading. However, delayed data could be enough for long-term analytics.

Verify the frequency of updating data (e.g. hourly or minute by minute, daily).

Historical data accuracy - Ensure that all historical data is uniform and free of any gaps or anomalies.

3. Evaluate Data Completeness

Find missing data.

Coverage - Make sure the platform you select covers all stocks, indices and other markets that are relevant to trading strategies.

Corporate actions: Check if the platform is able to account for dividends, stock splits mergers and other corporate actions.

4. Accuracy of Test Data

Cross-verify data: Compare the data from the platform to other reliable sources to ensure that the data is consistent.

Error detection - Search for outliers and incorrect pricing or financial indicators that have not matched.

Backtesting - Use historical data for backtesting trading strategies to determine if the results are in line with expectations.

5. Granularity of data is evaluated

The platform should provide granular information, including intraday prices volumes, volumes, bid-ask as well as order book depth.

Financial metrics: Verify that the platform offers complete financial statements (including the balance sheet, income statement and cash flow and also important ratios (such as P/E, ROE, and P/B. ).

6. Check for Data Preprocessing and Cleaning

Normalization of data - Make sure that the platform normalizes your data (e.g. adjusting for splits or dividends). This will ensure consistency.

Outlier handling: Check how the platform handles anomalies or outliers in the data.

Missing data imputation: Check to see if your platform is using solid methods to fill in the data that is missing.

7. Examine data for consistency

Timezone alignment: Ensure all data is aligned with the same timezone in order to avoid discrepancies.

Format consistency: Make sure that the data is formatted in a consistent format.

Cross-market consistency: Verify that the data from various exchanges or markets is consistent.

8. Determine the relevancy of data

Relevance to your trading strategy: Check that the data you're using is in accordance with your trading style (e.g. technical analysis, qualitative modeling and fundamental analysis).

Features Selection: Find out whether the platform has relevant features, such as economic indicators, sentiment analysis and news information which can improve predictions.

Check the integrity and security of your data

Data encryption: Make sure the platform is encrypted to safeguard information during storage and transmission.

Tamper-proofing : Make sure whether the data hasn't been manipulated by the platform.

Compliance: Check whether the platform is compliant with the rules for data protection (e.g. CCPA, GDPR).

10. Transparency Model for AI Platform Tested

Explainability: Ensure that the platform offers insight on how the AI model uses the data to make predictions.

Bias detection: Find out whether the platform monitors and mitigates biases in the model or data.

Performance metrics. Evaluate performance metrics such as accuracy, precision, and recall to assess the reliability of the platform.

Bonus Tips:

Feedback and reviews from users Review and feedback from users: Use user feedback to determine the reliability of a platform and its data quality.

Trial period: Test the platform for free to test the functionality and what features are offered before you commit.

Support for customers - Ensure that the platform is able to offer a robust customer support to address any data related problems.

If you follow these guidelines to help you better evaluate the data quality and sources of AI stock prediction platforms and make sure you are making informed and reliable trading decisions. View the top rated ai stocks for website recommendations including investment ai, market ai, ai investing platform, investment ai, best ai trading app, ai investing app, ai for investing, ai stock trading app, ai stock picker, ai for investment and more.

Top 10 Tips For Evaluating The Regulatory Conformity Of Ai Stock Prediction/Analyzing Trading Platforms

Regulatory compliance is a critical aspect to consider when looking at AI trading platforms for stock prediction or analysis. Compliance is crucial as it guarantees that the platform complies with rules and legal frameworks. It also protects the user's data. Here are 10 top tips for evaluating the regulatory compliance of such platforms:

1. Verify License and Registration

The regulatory bodies should ensure that the platform is registered with and regulated by the appropriate financial regulatory authorities (e.g., SEC in the U.S., FCA in the UK, ASIC in Australia).

Verify the broker partnership. If the platform is integrated with brokers, ensure that they are properly licensed and regulated.

Public records: Check the official website of the regulator for the status of registration for the platform and any previous violations.

2. Assessment of the Data Privacy Compliance

GDPR - If your website is located in the EU and/or provides services to users in the EU make sure that it complies with GDPR.

CCPA – For Californian users Check compliance with California Consumer Privacy Act.

Policies on handling data: Read the data privacy policy of the platform to determine what it says about the collection, storage, and sharing.

3. Assessing Anti-Money Laundering measures

AML policies - Ensure that the platform's AML policies are strong and effective to detect the existence of money laundering.

KYC procedures: Determine if the platform follows Know Your Customer (KYC) procedures for verifying the identities of users.

Monitor transactions: Make sure that the platform monitors transactions to spot suspicious behaviour and alerts relevant authorities.

4. Make sure that you are in conformity to Trading Regulations

Market manipulation: Check that the platform has measures in place to prevent manipulation of the market, like spoofing or wash trading.

Types of orders: Make sure that the platform is compliant with regulations pertaining to different types of orders (e.g. no stop-loss that is illegal to hunt).

Best execution : Ensure that the platform uses best execution methods to make trades at the lowest cost.

5. Cybersecurity Assessment

Data encryption. Ensure your platform uses encryption for user data, both in transit and at rest.

Incident response. Verify whether the platform has a plan of action to handle data breaches and cyberattacks.

Check for any certifications.

6. Evaluate Transparency and Transparency

Fee disclosure. Be sure that all fees and charges are clearly stated, as well as any hidden or additional costs.

Risk disclosure: Make sure that the platform provides explicit risk disclosures. Particularly for high-risk and leveraged trading strategies.

Performance reporting: Determine whether the AI platform's models are clear and properly and accurately reported.

7. Verify the conformity to International Regulations

Transparency in trading across borders: If you are trading internationally, make sure that the platform is compliant with all applicable regulations.

Tax reporting: Verify whether there are tax reporting tools or reports available to assist you with tax laws.

Security: Make sure whether the platform is in compliance with international sanctions and does not permit trading with prohibited entities or countries.

8. Assessing Record-Keeping and Audit trails

Transaction records: Ensure that the platform has complete records for purposes of regulation and audit.

Logs of user activity (logs) You can check to see if the platform tracks the user's activities, including trading and logins. Also, check if the settings for your account have been modified.

Audit readiness: Ensure that the platform can provide all documents and logs in the event of the need for a regulatory audit arises.

9. Verify compliance with AI-specific Regulations

Algorithmic rules for trading: If your trading platform supports algorithms, check that it is in compliance with the rules of MiFID II for Europe or Reg. SCI for the U.S.

Bias and fairness: Verify whether the platform is able to monitor and corrects biases within its AI models to ensure ethical and fair trading.

Explainability: As required by specific regulations, the system must provide clear explanations of AI-driven predictions and decisions.

10. Review User Comments as well as Regulatory Historical The History

User reviews: Conduct user studies to determine the platform's reputation in terms of regulatory compliance.

History of regulatory violations - Check to see if the platform is associated with any prior penalties or violations of regulations.

Third-party inspections: Check if the platform is subjected to regular third-party inspections to ensure that the platform is in compliance.

Bonus Tips

Legal consultation: Consult a lawyer to ensure the platform is in compliance with all applicable regulations.

Trial period. Use the free trial or demo of the platform to test its features for compliance.

Customer support - Make sure that the platform is able to help with any compliance related issues or concerns.

Follow these tips to evaluate the regulatory compliance and security of your rights. Compliance not only reduces legal risks, but also increases confidence and trust in the service of the platform. Read the recommended ai stock predictions info for blog info including chart analysis ai, ai investment tools, stock trading ai, how to use ai for stock trading, best ai trading platform, stock predictor, investing with ai, trading ai tool, ai for trading stocks, ai stock trader and more.